Real property owners in San Pedro City who are in arrears in their real property taxes can now avail themselves of a tax amnesty under a new measure signed by President Ferdinand "Bongbong" Marcos, Jr. last June.

In an interview with OpinYon Laguna, officials from the San Pedro City Treasurer’s Office urged property owners to take advantage of the implementation of Republic Act No. 12001 (Real Property Valuation and Assessment Reform Act), which was signed into law by President Marcos on June 13, 2024.

Standardization

RA 12001 aims to standardize the real property valuation in the Philippines to reflect the current market values, in order to promote the sustainable development and maintenance of a just, equitable, impartial, and nationally consistent real property valuation based on international valuation standards, concepts, principles, and practices.

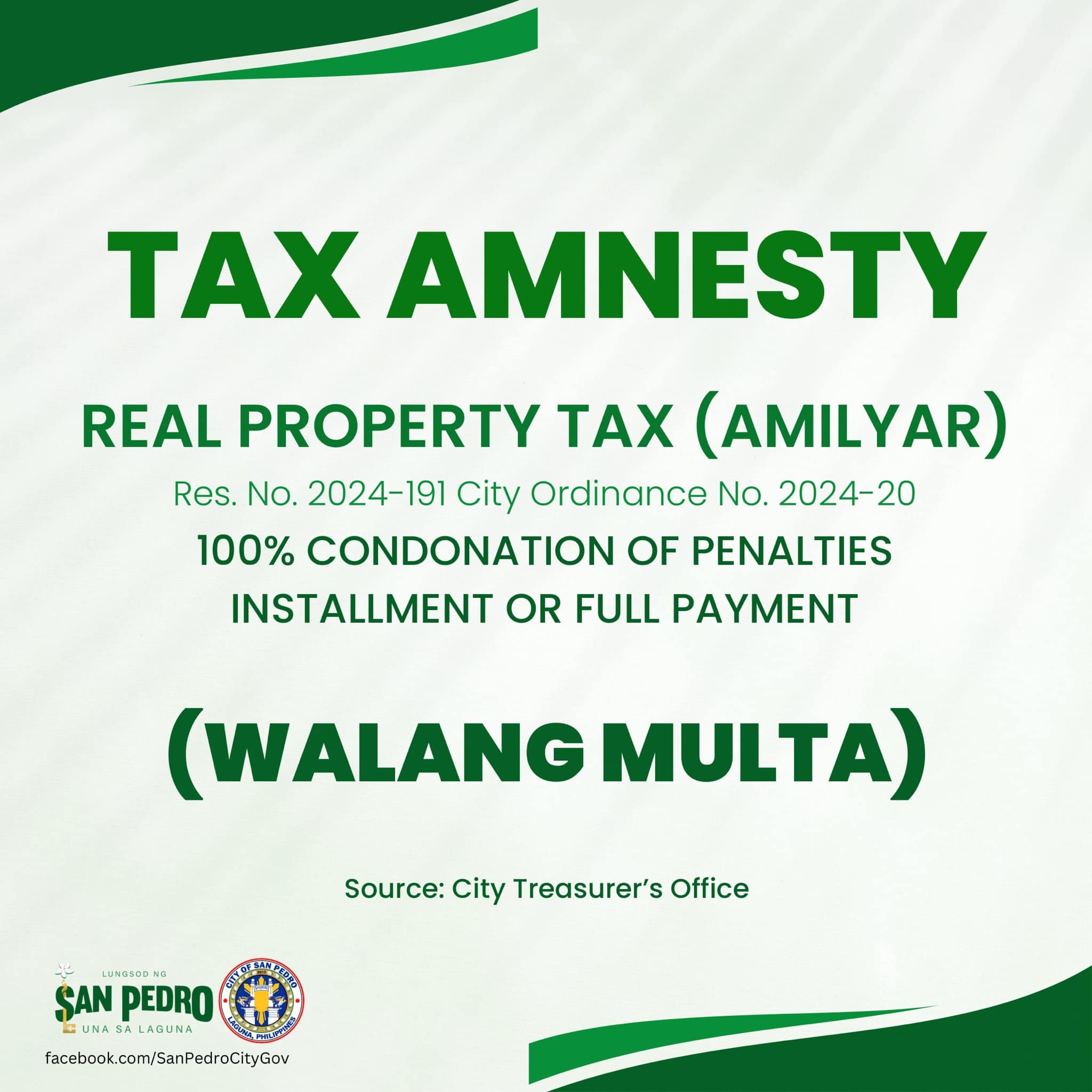

Section 30 of RA 12001 grants a two-year amnesty (covering the period from June 2024 to June 2026), covering penalties, surcharges and interests from all unpaid real property taxes, including Special Education Fund, idle land tax, and other special levy taxes, prior to the effectiveness of the law.

However, the amnesty does not extend to the following real properties: delinquent real properties which have been disposed of at public auction to satisfy the real property tax delinquencies; real properties with tax delinquencies which are being paid pursuant to a compromise agreement; and real properties subject of pending cases in court for real property tax delinquencies.

“Kaya po nagbigay ang ating gobyerno ng tax amnesty under RA 12001 ay upang ayusin ng ating mga assessor ang ating mga property valuation for at least two years,” Bebeth Abaigar, head of the San Pedro City Treasurer’s Office, told OpinYon Laguna.

“After nitong tax amnesty, dere-derecho na po ulit ang assessment ng real property [under the new valuation standards] every three years,” she added.

Starting local implementation

While the implementing rules and regulations (IRR) of RA 10021 have yet to be adopted by the national government, Abaigar said her office has requested the Sangguniang Panglungsod to adopt a local resolution for the adoption of the new law at the city level.

Since, under the tax amnesty, penalties for late payment of real estate property taxes will be waived, the Treasury head noted that delinquent real property owners can pay their dues through installments within the two-year period covered by the amnesty.

“Sa aming tanggapan po kasi, since two years po ang ating tax amnesty, pinapayagan na po natin yung mga real property owners na may delinquencies na magbayad kahit installment, lalo na yung mga nahihirapang magbayad ng full dues nila, hanggang sa mabayaran na nila ang kanilang delinquency,” she explained.

Added income

The two-year tax amnesty will not only be beneficial to delinquent real property tax owners but for the city government as well, Abaigar added.

This is for the simple reason that the funds collected from the payment of real estate taxes will also be used by the city government, not just for its day-to-day operating expenses but also for providing much-needed social services to San Pedrenses.

“Siyempre po, kapag nakapagbayad na sila ng real property tax, lalaki po ang income ng ating local government. At kung lalaki po ang income ng ating city government, lalaki rin po ang mga benepisyo na pwede nating maibigay sa ating mga kababayan. And at the end of the year, kung wala na pong delinquency sa ating mga real property owners, fixed na po ang income ng ating lungsod. So our goal po talaga is zero delinquency po," the Treasury head noted.

Data released to OpinYon Laguna showed that the city could collect up to P90 million in basic taxes alone from the delinquent accounts.

Property owners should take advantage

Abaigar urged delinquent real property owners to take advantage of the tax amnesty to settle their unpaid real property taxes with the city government, as this will enable them to clear their obligations without the need to pay hefty penalties.

“Alam naman po natin na malaki po ang penalty sa hindi pagbabayad ng real property tax, around 24 percent per annum [per year]. Tapos compounded pa iyon sa bawat taon na hindi kayo nakakapagbayad ng real property tax, lalo na kapag mahaba na yung panahon na delinquent ang property owner,” she explained.

“Kaya po hinihikayat natin ang ating mga real property owners na samantalahin na itong tax amnesty na ibinibigay ng national government, dahil ang laki po ng mawawala na penalty kapag nagbayad na tayo ngayon.”

#WeTakeAStand #OpinYon #OpinYonNews #SanPedroLGU #TaxAmnesty