Businesses inside the Subic Bay Freeport are not owned exclusively by Filipinos. Many locators are owned and operated by foreign investors, who employ both skilled blue-collar workers and white-collar employees. Foreign capital, local business operations and export revenues all have a bearing on computations of taxes due to the government of the Philippines.

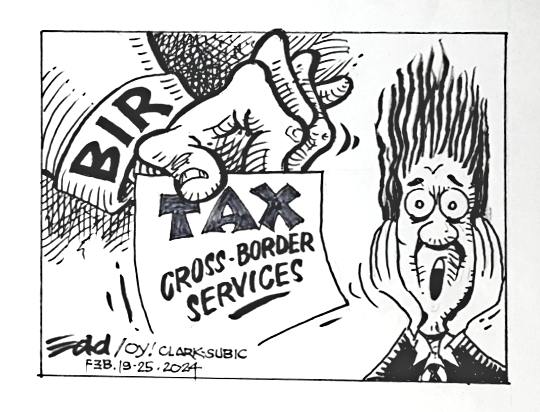

The Bureau of Internal Revenue (BIR) has a new policy that mandates high tax fees on cross-border services. This has a potential detrimental effect on attracting foreign and local businesses in the country.

Business establishments inside the Subic Bay Freeport are also affected by this policy, and we hear they have joined business groups in requesting the BIR for a stay of implementation of this process.

In a joint statement on Feb. 15, the groups expressed their concern regarding Revenue Memorandum Circular (RMC) No. 5-2024, which was issued on Jan. 10, which subjects services performed by non-resident foreign corporations (NFRCs) for a Philippine entity to 25 percent withholding tax and 12 percent final withholding value-added tax (VAT).

As per the policy, "the jurisdiction providing the essential service for income generation is entitled to tax the income for cross-border services."

These services include consulting, outsourcing, financial, telecommunications, engineering and construction, education and training, tourism and hospitality, and others. Overall, the groups said that RMC No. 5-2024 will "result in increased cost of doing business in the Philippines," contrary to the national government's goal of enticing more investors to the country.

It is a fact that foreign investors would evaluate the tax regime of a country prior to entering deals or partnerships for investments, with companies opting for "justified tax costs" along with "profitable and manageable transactions." This is part of what you call “due diligence” in investing. With the numerous business opportunities and activities in the Subic Freeport, the role of taxation in the process of due diligence is quite important.

Business organizations and economists say prohibitive tax rates would disincentive prospective foreign investors to the Subic Freeport, considering that there are other ports in neighboring countries that may offer lower tax rates.

This reality is something for the policymakers in the Bureau of Internal Revenue, and newly minted Finance Secretary Ralph Recto to consider.

#WeTakeAStand #Opinyon #Subic #BIR