In a significant stride towards modernization and enhanced taxpayer convenience, the Bureau of Internal Revenue (BIR) has declared a pivotal shift in acquiring Tax Identification Numbers (TIN) and corresponding IDs. The recently issued Memorandum Circular 120-123, announced by BIR Commissioner Romeo Lumagui Jr. on Nov. 29, signifies a departure from the traditional practice of enduring long lines at Revenue District Offices for TIN ID issuance. The move aims to harness technology, eliminate fixers, and foster a more efficient and secure system.

Eliminating Hassles, Uprooting Fixers:

Commissioner Lumagui emphasizes that introducing the Digital TIN ID system aligns with the BIR's commitment to Excellent Taxpayer Service. By integrating this digital feature into the Online Registration and Update System (ORUS), the bureau not only simplifies the TIN ID application process but also takes a significant step towards eradicating fixers and scammers who exploit unsuspecting taxpayers.

Streamlining Application Procedures:

Individual taxpayers with existing TINs can seamlessly apply for the digital TIN ID through the ORUS platform. The process is streamlined further by allowing applicants to update their email addresses online via Form S1905 – Registration Update Sheet (RUS) through email or BIR's eServices – Taxpayer Registration Related Application (TRRA) Portal.

Caution Against Irregularities:

BIR has laid out clear guidelines, including submitting a genuine photo, to ensure the authenticity of the digital TIN ID. This move is to uphold the system's integrity and deter individuals from submitting misleading or unrelated images. BIR warns that violating these rules could result in penalties.

Versatility and Validity:

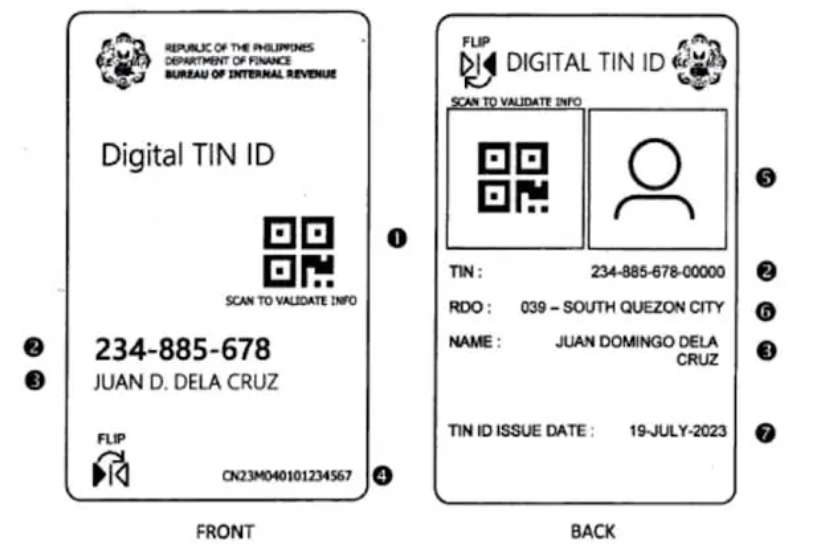

The Digital TIN ID is a versatile and valid government-issued identification document accepted across various entities, including government agencies, local government units, banks, employers, and other institutions. Its validity and authenticity can be easily verified online using the QR Code provided within the ORUS system.

Permanence and Cost-Free Assurance:

Unlike physical TIN cards, the Digital TIN ID, once obtained, remains a permanent identification document. BIR underscores that the digital version is free of charge, dispelling any notion of it being available for sale. This assurance safeguards taxpayers from falling victim to unscrupulous online sellers and ensures equitable access to this essential identification.

The BIR's transition to a digitalized TIN ID issuance system is a commendable move towards harnessing technology to enhance taxpayer services and eliminate malpractices. By providing a convenient and secure alternative to traditional methods, the bureau reinforces its commitment to efficient governance and empowers taxpayers in their interactions with various institutions. As we witness this transformative shift, it becomes evident that embracing technology is not just a choice but a necessity in fostering a more transparent, accessible, and resilient public service landscape.

#OpinYonPanay #BIR #BureauOfInternalRevenue #Tax #TIN #DigitalTINID #ORUS #TRRAPortal #OpinYon #WeTakeAStand