Although the festering brownouts that lasted for more than 24 hours and brought business and other activities to a stand still occurred in Panay and Negros islands, the problem eventually took on a national character because that is how things are — the islands are interconnected, and you cannot separate both good events and disasters from one another as Luzon, Visayas and Mindanao are just one.

Households and businesses in Panay Island were plunged into darkness on January 2. The National Grid Corp. of the Philippines (NGCP) which is responsible for operating, maintaining, and developing the country’s state-owned power grid explained that there were tripping of multiple power plants, with the entire Negros-Panay grid eventually shutting down.

Sen. Grace Poe, chair of the Senate public services committee, criticizing the firm for preventing a repeat of the huge power outage last April. The Iloilo City LGU said that the economic losses caused by the three-day power outage have been estimated at P1.5 billion, while some 740 public schools have suspended classes.

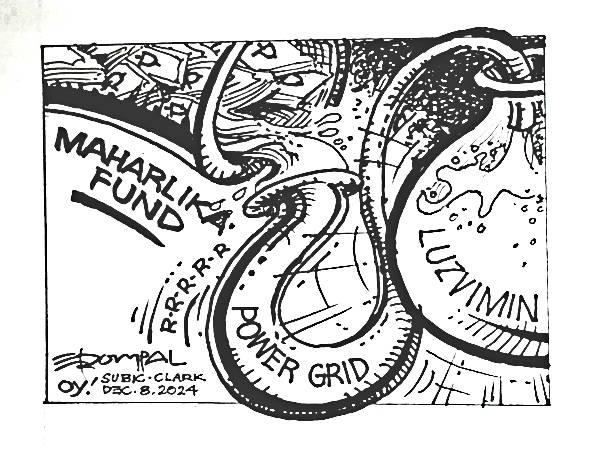

As power supply problems continued in Western Visayas, House Speaker Martin Romualdez has proposed to use the Maharlika fund to invest in NGCP to improve its operations. Romualdez said that potential investments made by the Maharlika Investment Corp. could help bankroll improvements to the power grid’s infrastructure and lead to “improved efficiency.”

The MIF “could provide the NGCP with essential capital for infrastructure upgrades and help in lowering the cost of electricity for consumers. The involvement of the Maharlika Investment Corp. could be a significant step towards achieving a reliable, efficient, and sustainable energy infrastructure,” the House speaker stressed.

In response, the NGCP said in a statement that there is a “need for improved planning to ensure sufficient generation per island, with a well-balanced mix of fuels and technology.”

Senate President Juan Miguel Zubiri was “incensed and dismayed by the persistent power outages” and claimed that he was the first one to suggest that Maharlika Fund money should be invested in power generation and distribution.

These suggestions from the legislative leaders is timely because the Maharlika Investment Corp. held its first board meeting on Wednesday to discuss its fund capitalization and identify the potential sectors it can tap to achieve value creation.

Among others, it listed the sectors of infrastructure; oil, gas, and power; agroforestry industrial urbanization and mineral processing.

So, there…the MIC already has some ideas to consider, and coming from the two top leaders of Congress even.

#OpinYonSubic #Editorial #MaharlikaFundToTheRescue? #MaharlikaFund #NGCP #Energy #OpinYon #WeTakeAStand