Aminin man natin o hindi, pataas ng pataas ang presyo ng lahat ng bagay—mula langis (lalo na ang diesel para sa pampasaherong sasakyan), pagkain, tubig, kuryente at pati na rin ang mga softdrinks, noodles (na pangmahihirap) mga powdered juice drinks (na ngayo’y 18 kada sachet sa mga groceries) at pati na rin ang mga school supplies, sapatos and libro ng mga magaaral.

Tila wala ka ng masasalubog na tao na masaya sa kanilang pinamimili dahil sa sobrang mahal. Para bang ang piso ngayo’y nagkakahalaga na lang ng bente sentimos.

Kaya’t hindi kataka-taka nang sinabi ng Philippine Statistics Authority na ang inflation noong June lang ay umabot na sa 6.1 percent, na siyang ikinagulat at madaliang dineny ng pangulo na sabi niya’y mga 4.4 percent lamang. Ngunit dali dali niya rin itong binago matapos na mapalinawagan ng mga statisticians.

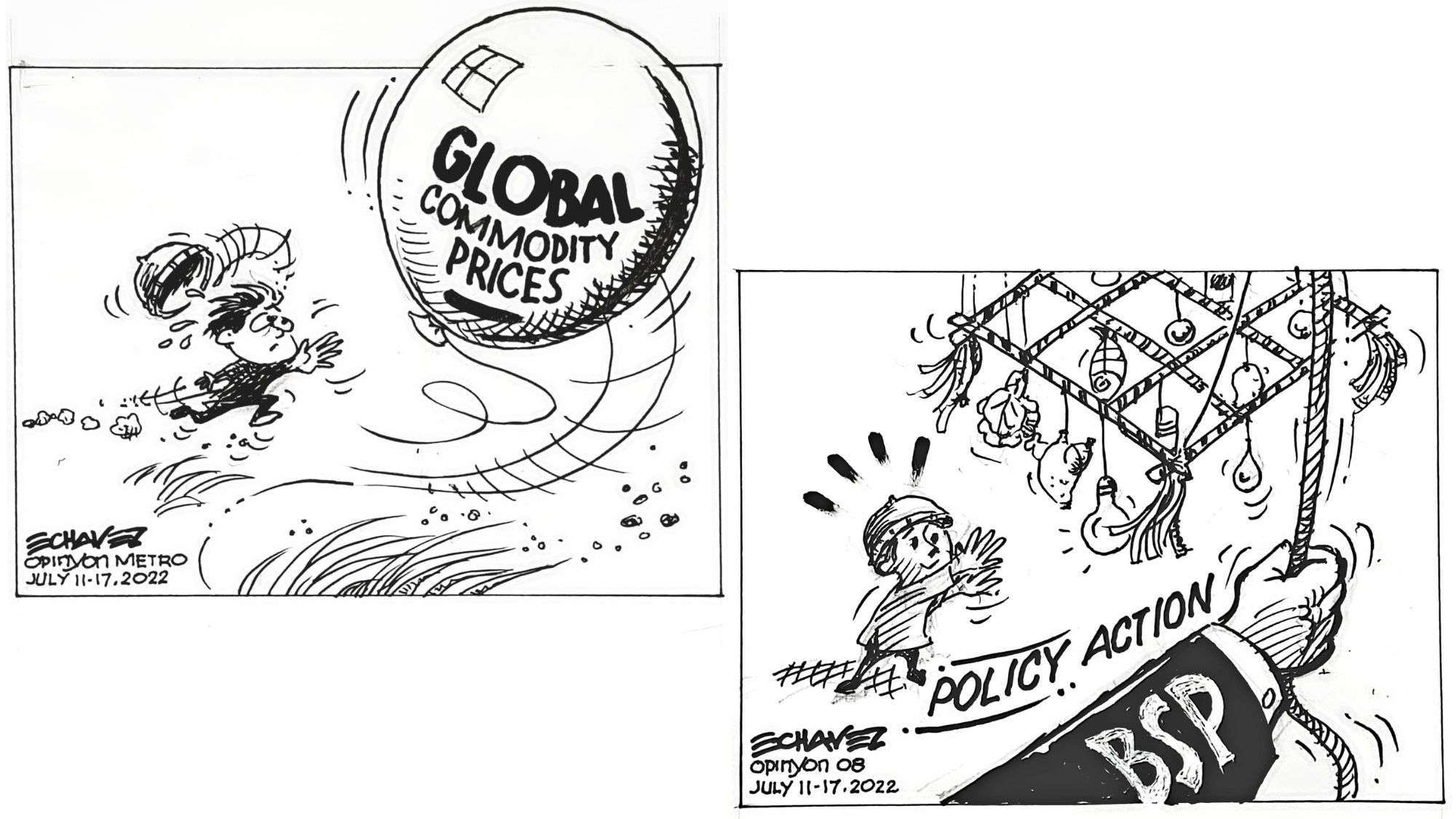

Noong Tuesday, sinabi ng Bangko Sentral ng Pilipinas na ang continued rise in global commodity prices and more pronounced second-round effects on domestic goods and services will trigger more price increases of local commodities ahead. In short mas tataas pa ang inflation kesa sa 6 percent ng June.

Ang explanation ng BSP: “The balance of risks to the inflation outlook is likewise skewed to the upside for 2022 and 2023, with pressures emanating from the potential impact of higher global non-oil prices, the continued shortage in domestic fish supply, and pending petitions for transport fare hikes due to elevated oil prices.”

Sinangayunan ito ng economists ng Bank of the Philippine Island saying

“Inflation has probably not peaked yet in June and may continue to go up until October assuming oil prices will stay at current levels.”

“The contribution of food to inflation will expand further given the shortage of certain items in the international market amid the conflict in Ukraine and the trade restrictions being put in place by exporting countries like India and Indonesia,” BPI said.

“The contribution of transport to inflation will likely expand because of the recently approved fare hike for jeepneys. With road transport services accounting for 4.29 percent of the consumer basket, we expect a 0.2-percent increase in the upcoming inflation prints” because of the P2 hike in jeepney fares,” dagdag pa ng bangkong ito.

RCBC chief economist Michael Ricafort said new taxes, being proposed for the government’s fiscal consolidation plan, could likely fuel higher inflation in the coming months.

“The proposed higher taxes or new taxes for the coming months could potentially lead to some pick up in prices and overall inflation, as an unintended consequence, as part of the efforts to narrow the country’s budget deficit,” sabi ni Ricafort.

The acceleration of inflation in June is also set to trigger a more aggressive tightening path from the BSP, according to ING Bank economist Nicholas Mapa.

“July inflation will likely push above 6 percent again and we believe this will be enough to convince BSP to whip out a more forceful 50 basis point rate adjustment at their August policy meeting. We expect BSP’s policy rate to end the year at 3.5 percent or higher.”

Sabi ng BSP na handa itong gumamit ng necessary policy actions to “bring inflation back to a target-consistent path over the medium term and deliver on its primary mandate of price stability.”