While world economies are projecting a challenging and dismal economic growth after the pandemic, the banking sector itself is pleasantly astounded it emerged unscathed. Globally, that is.

The financial industry in Southeast Asia — specifically the ASEAN-5 and Brunei — is even more surprised it remained consolidated although the usual cluster of traditional depositors and investors became static in terms of banking penetration. (ASEAN-5 includes Indonesia, Malaysia, Philippines, Singapore, and Thailand.)

The Philippines, as figured in the recent study of McKinsey & Company, a global management company founded in 1926, ranks lowest in banking penetration at 56 percent. The group based this on Bangko Sentral ng Pilipinas data.

Both ASEAN-5 and Brunei recognize that the emergence of the digital-savvy and millennial markets could actually boost to greater heights bank penetration. Thailand marks 96 percent in bank penetration and 88 percent in Malaysia. Ironically, the McKinsey numbers run contradictory to the Philippines' status as one of the fastest growing economies in the region.

As the BSP target to lure at least 50 percent of its clients to shift to digital or online banking, still, 70 percent of traditional Filipino depositors are stuck with maintaining formal financial accounts.

Already, in all of ASEAN-5 and Brunei, the digital-savvy and millennials belong to this chunk of new bankers. They are very adept in online marketing. Their startup businesses are processed via remote financial transactions. Therefore, they need the banking institutions as a marketing medium.

This banking penetration apparent in the Mckinsey study finds that the share of digital payments in total retail transactions also increased to 30.3 percent from 20.1 percent in 2020, the height of the pandemic.

The 2023 percentage has almost doubled that of 2019's 29 percent still categorizing the Philippines as the laggard in the region in terms of bank penetration.

Even if Filipinos — young and traditional — opt to keep their earnings in banks for safety, they are affected with unabated inflation. Hence, their money's worth becomes of lesser value over time, considering bank fees if they go low and beyond security deposit level.

It is understandable that banks focus on industry and bigger-earning clients and barely make exert extra effort to communicate with potential startup groups.

The new breed of bankables in the Philippines is expected to grow by 30 percent to 85 million in 2030 from 65 million in 2022, McKinsey projects.

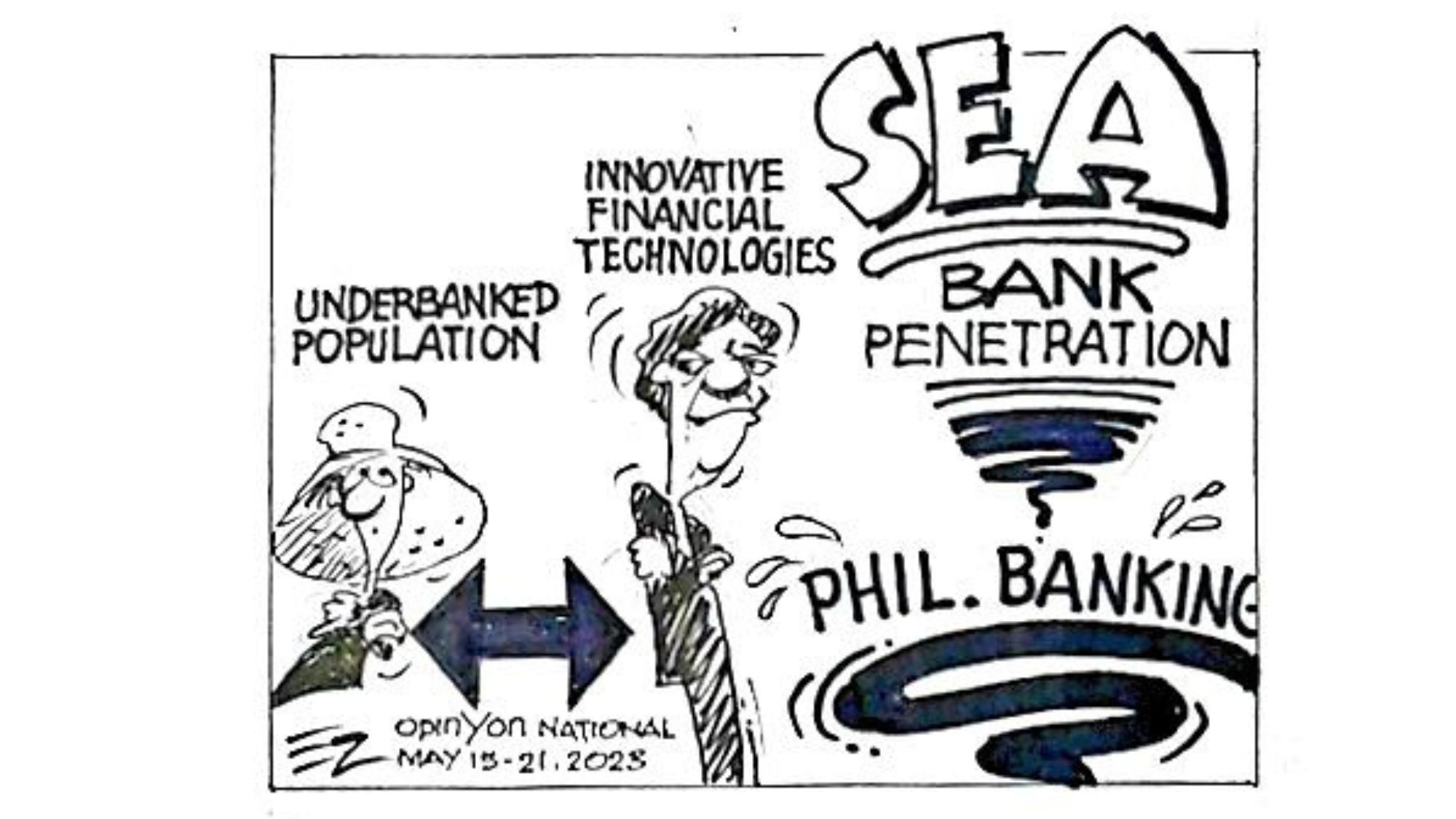

McKinsey sees a widening gap between the Philippine's enormous underbanked population and the expanding range of innovative financial technologies lying just beyond its borders.