Paying taxes is something citizens of organized society cannot dodge. Taxes are the lifeblood of all governments, because they need money to render service to their constituents. Benjamin Franklin, one of America’s founding fathers, aired a quote that is as true today as it was in 1787: “Our new Constitution is now established, everything seems to promise it will be durable; but, in this world, nothing is certain except death and taxes.”

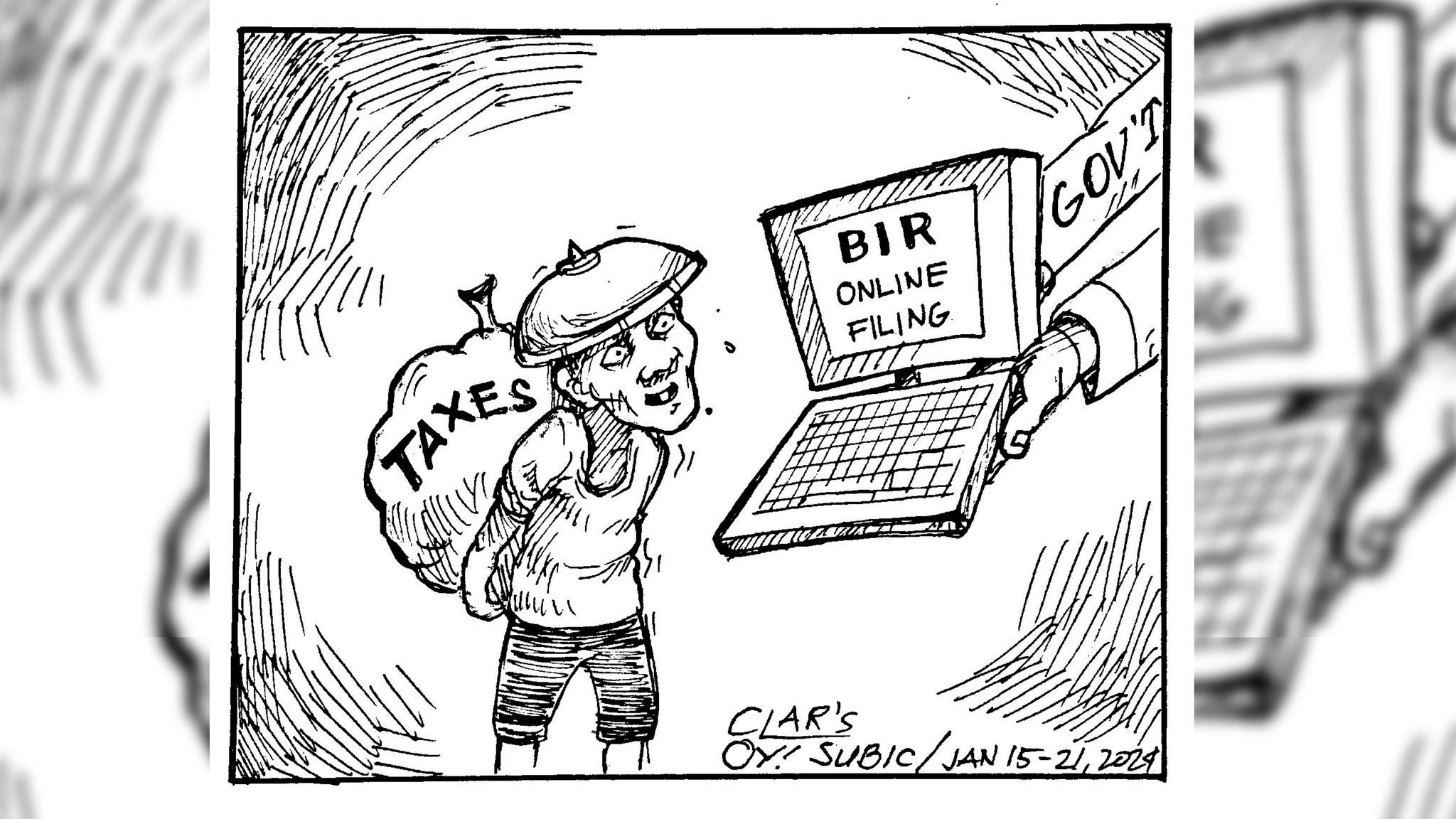

The offices of local treasurers and Bureau of Internal Revenue (BIR) branches are making the payment of taxes a little easier to the public. They provide air-conditioned waiting areas, enough teller windows, snacks, TV entertainment, etc. Cities and towns give hefty discounts for landowners paying their real property taxes ahead of the deadline. They also accept payments online, and for those paying face-to-face, several local government units (LGUs) are opening their offices even on weekends this first month of the year.

President Marcos Jr. signed into law a measure aimed at simplifying the tax filing process for small and medium enterprises and improve revenue collection through digitalization initiatives. Republic Act (RA) 11976 was one of the priority legislation mentioned by Marcos during his previous State of the Nation Address.

The new law introduces administrative tax reforms and amendments to several sections of the National Internal Revenue Code of 1997, also eyes to update the Philippine taxation system, adopt best practices, and replace antiquated procedures. The measure also simplifies procedures by allowing taxpayers to electronically or manually file tax returns with the BIR, any authorized agent bank or authorized tax software provider.

The Ease of Paying Taxes Act is expected to be an effective catalyst for foreign direct investments (FDIs) and enhance the country’s competitiveness as an investment destination. Digitalization is the most important facet of this law, and the measure mandates the Bureau of Internal Revenue to come up with its digitalization roadmap that will be submitted to Congress and updated regularly.

As approved, the law will make it easier for medium-size foreign companies to set up shop locally. The measure will provide more equitable and simplified tax compliance requirements, promote taxpayer’s welfare, and guarantee sustained revenue growth. It will also simplify tax filings for micro and small enterprises, allow for the electronic filing of taxes, and accelerate value-added tax (VAT) refunds by shifting to an invoice system.

Adopting integrated and automated systems for facilitating basic tax services, setting up electronic and online systems for data and information exchange between offices and departments, streamlining procedures by adopting automation and digitalization of BIR services, and building up BIR’s technology capabilities are among the list of digitization initiatives that would be implemented.

We are confident the new law will help the government raise more money for its operations.

#OpinYonSubic #Editorial #DeathAndTaxes #Tax #BIR #EaseOfPayingTaxes #OpinYon #WeTakeAStand