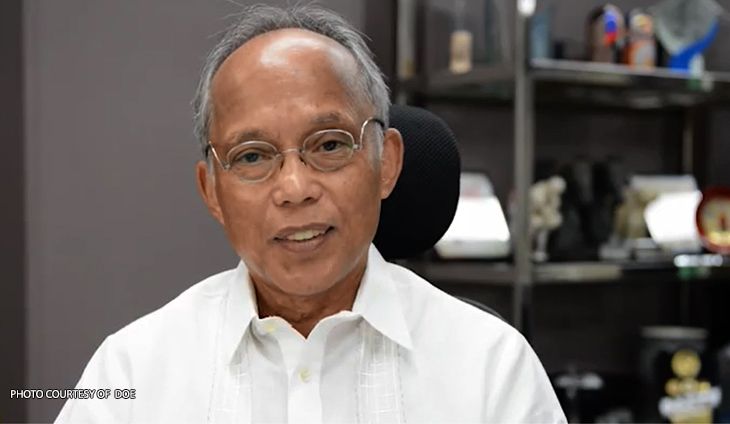

Knowing fully well Duterte-crony Dennis Uy of Udenna Corporation Malampaya (UC Malampaya) was mired in debt, still the Department of Energy led by former Secretary Alfonso Cusi approved Uy’s purchase of Chevron’s stake in Service Contract 38 oil and gas project.

The Ombudsman said Cusi ignored the report of the Philippine National Oil Company-Exploration Corp. (PNOC) that flagged Uy’s Udenna Corporation Malampaya (UC Malampaya) as financially and technically unfit to buy Chevron’s stake in the Service Contract 38 oil and gas project, reported Bilyonaryo.

Citing PNOC-EC's findings, the Ombudsman’s office in its recent ruling found Cusi and 11 other DoE officials liable for violation of the anti-corruption law for railroading Uy’s acquisition of Chevron in March 2020.

“The PNOC-EC due diligence report focused on Udenna in light of the fact that UC Malampaya had just been newly- incorporated (September 2019). The report stated, among other things, that Udenna’s business is heavily funded by debt, and it does not have the capacity to acquire its desired interest in SC38 in the amount of $565 million without external financing,” the Ombudsman said.

‘Walang pera’

“Aside from the operating costs, there are other financial obligations that UC Malampaya would participate in as a prospective member of SC38. As ex-officio chairperson of PNOC-EC, Cusi was presumably aware of the results of the ‘due diligence’ conducted, but evidently ignored the findings,” it added.

The Ombudsman noted that Cusi himself admitted that UC Malampaya “had no money (walang pera)” in his testimony in the Senate in December 2021.

The Ombudsman also flagged UC Malampaya’s lack of technical capacity. Despite assurances that Chevron’s staff would be retained post-sale, PNOC-EC noted the loss of global technical support previously provided by Chevron.

“Undoubtedly with the assignment, UC Malampaya would be left with no global technical support that its seller/assignor had prior to the transaction,” the Ombudsman said.

The Ombudsman said the DOE should have already disqualified UC Malampaya at the start for having a negative working capital of $137.156 million and its submission of unsigned, unaudited financial statements during the mandatory evaluation process.

The Ombudsman criticized the DoE’s approval of the deal, stating, “The privilege or benefit was undue and unwarranted as UC Malampaya is financially and technically incapable of carrying out the contractual obligations under SC38.”

Aside from Cusi, who was also PNOC -Exploration Chairman, the other DOE officials charged for corruption are: Undersecretaries Donato D. Marcos and Robert B. Uy; Assistant Secretaries Gerardo D. Erquiza Jr. and Leonido J. Pulido III; Energy Resource Development (ERD) Director Cesar G. Dela Fuente III; ERD Assistant Director Guillermo H. Ansay; Director Araceli A. Santos-Soluta, Conventional Energy Resources Compliance Division Chief Thelma M. Cerdena; Petroleum Resources Development Supervisor Demujin F. Antiporda; Energy Director for legal Arthur Tenazas; and DOE lawyer Rowena Joyce A. Delos Santos.

It was gathered that the Ombudsman found probable cause against Cusi and his alleged conspirators in the DoE for violation of Section 3(e) of Republic Act No. 3019 or the Anti-Graft and Corrupt Practices Act, specifically Section 3(e), which bans public officials from corrupt acts, like unfairly favoring a private party through bias, bad faith, or negligence.

If guilty, they face dismissal, 6 to 15 years in prison, and a lifetime ban from public office.

The Ombudsman accused Cusi and other respondents of working together to approve Uy’s Malampaya deal and turning a blind eye to major red flags. They allegedly approved the transfer of Chevron’s 45 percent stake to Uy’s company, Udenna Corp. (UC) Malampaya, even though it has a negative capital of $137.156 million, no technical expertise, and incomplete, unaudited documents.

Worse, the Ombudsman noted they allegedly used financial evaluations from a different company (UC38LLC) with a working capital of $177.421 million to make it appear that Udenna was qualified.

Uy, whose debt-fueled business empire has been hobbled by serious cash problems, shelled out $565 million for the 45 percent stake of Chevron in 2019.

In 2022, ultra billionaire Ricky Razon’s Prime Infrastructure Capital acquired Shell’s 45 percent stake in Malampaya.

#WeTakeAStand #OpinYon #OpinYonNews #DoE