The Philippines plans to tap the funds to be raised by GEAPP worth $10 billion to shift from coal to renewable energy for its energy mix. Similarly, a private-sector fund-raising commitment of $130 million under GFANZ will also be made available to countries to lessen their carbon footprints.

FOLLOWING the pledges of $130 trillion raised by an international coalition of private financial institutions in Glasgow early this month for use in shifting global economies to clean energy, the Philippines said it would gladly grab the $10 billion promised it to shift its power plants from coal to clean energy.

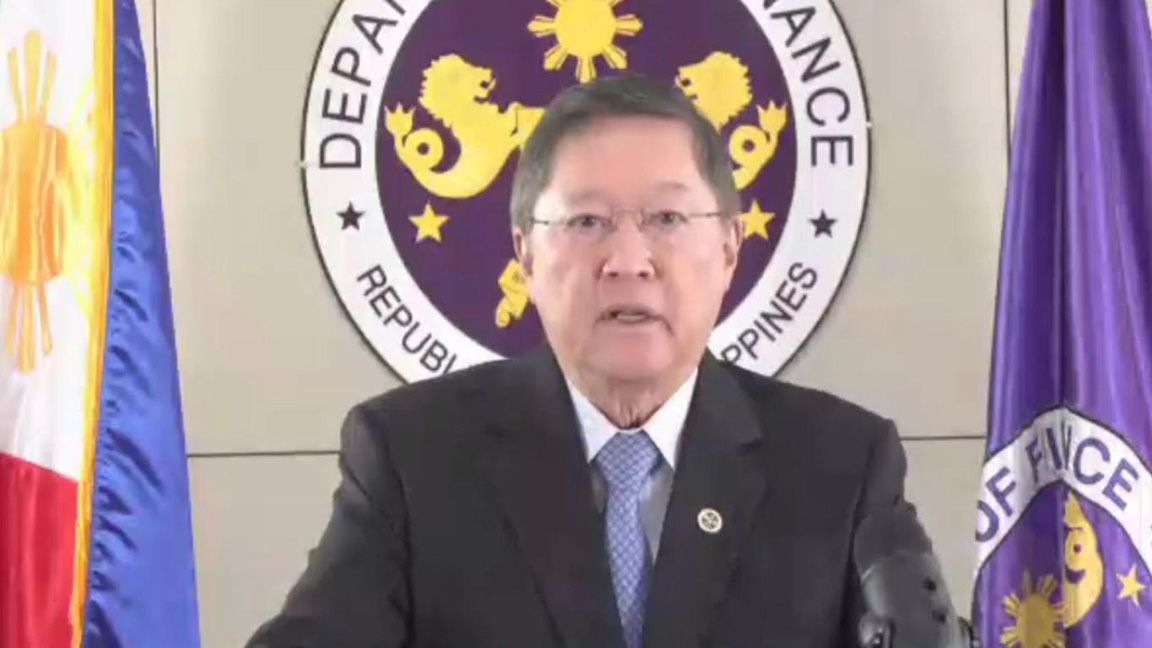

Finance Secretary Carlos G. Dominguez, who headed the Philippine delegation to the 26th UN climate change conference of parties (COP26) in Scotland, said the Philippines plans to tap a $10-billion global fund to help the country reduce its carbon emissions by transitioning to renewable energy.

Dominguez said yesterday he discussed with Rajiv Shah, president of The Rockefeller Foundation, the prospects of accessing the global fund raised by the group led by Bezos Earth Fund and IKEA Foundation.

Last week, the group launched at COP26 the Global Energy Alliance for People and Planet (GEAPP), a global fund that can be used by developing nations while they transition to renewable energy.

Dominguez told Shah of the Philippines’ plan to improve Mindanao’s hydropower facilities to wean the region away from coal energy. Dominguez has also asked Shah how the Philippines can work with GEAPP to speed up the country’s efforts to transition to renewable energy.

During the meeting, Dominguez said there should be a mix of grants, investments and subsidies in delivering the funding needs of nations most vulnerable to climate change. Shah, for his part, vowed to study this approach in partnering with developing economies like the Philippines.

Aside from the private sector, the GEAPP obtained its resources from three developed countries and eight multilateral lenders.

The global fund, composed of public and private capital, is expected to rise to $50 billion within the next five years, and then to $100 billion within the next decade to hasten the transition to renewable energy of more than 60 states across Africa, Asia and Latin America.

The GEAPP will serve as a platform for developmental work among economies involved, as well as a source for financing options ranging from project grants to technical assistance.

Japan last week pledged to grant $25 million for the energy transition mechanism of the Asian Development Bank. The ETM looks to retire coal plants and introduce alternative options in the Philippines and Indonesia.

54% coal in energy mix

Coal accounts for at least 54 percent of the country’s energy mix and, in turn, contributed about half of its carbon emissions in 2019. Through the ETM, the Philippines can decommission more than half of its coal facilities within the next 10 to 15 years.

Based on data from the Department of Finance, the country suffered P506.1 billion in economic losses to climate hazards between 2010 and 2020.

Despite the eye-popping pledge by many of the world’s biggest banks, climate experts say the commitment leaves unclear whether and how the trillions of dollars will be effectively marshaled into transitioning the world’s energy production away from fossil fuels.

GFANZ

The Glasgow Financial Alliance for Net Zero (GFANZ) — which represents more than 450 banks, insurers and other asset managers in dozens of countries — unveiled the pledge as world leaders in Glasgow prepared for a day of discussions related to financing clean energy development.

The “GFANZ” group is led by Mark Carney, former head of the Bank of England, and Mike Bloomberg, the billionaire financier. Under the pledge, the projects and companies generated by loans given by the financial institutions would be by 2050 “net zero,” meaning they would, in aggregate, not add to carbon emissions.

While much attention has been focused on the climate spending of governments around the world, leaders in Glasgow spent Wednesday pointing to the need for private capital to fund clean energy investment.

The falling price of renewable energy has increasingly made clean energy projects an attractive investment, and private capital has significantly more capacity to fund these efforts than governments alone can marshal.

Officials at the Department of Treasury say they have been focused on unlocking the approximately $2 trillion to $3 trillion they say is necessary in private sector investments to achieve a global net-zero economy, compared to the hundreds of billions nations have pledged in government spending, the Financial Times reported.

“As big as the public sector effort is across all our countries, the $100-trillion-plus price tag to address climate change globally is far bigger,” Treasury Secretary Janet L. Yellen said on Wednesday morning in Glasgow at an event devoted to climate finance. “The private sector is ready to supply the financing to set us on a course to avoid the worst effects of climate change.”

‘Publicity stunt’

Still, dozens of climate groups have criticized the Glasgow “financial alliance” as a publicity stunt — particularly because the commitment avoids calling for a cessation of financing of production of carbon-intensive fossil fuels.

Many of the same banks behind the pledge continue to finance the construction or expansion of coal plants, for instance. Environmental groups are adamant that new production of coal, oil and gas must be stopped to avoid the consequences of catastrophic warming. Since the Paris climate accord, large banks have financed more than $4 trillion in fees from the oil, gas, and coal industries, according to Bloomberg News.

“These commitments live and die on how they treat fossil fuels. It’s the elephant in the room that they seem to conveniently ignore,” said Justin Guay, a climate expert formerly at the Sierra Club. “Dealing with fossil fuels is not optional; it’s mandatory.”

Also unclear is exactly how the trillions in private capital will be effectively turned into clean energy projects, particularly for the developing world. Even if the banks set aside assets to be used for clean energy investments, that capital needs specific initiatives to finance.

The world leaders hailing the pledge recognized the ongoing obstacle. “Questions remain,” Yellen acknowledged. “Will enough investment opportunities materialize to absorb all this capital? How quickly can this reorientation occur?”

‘Watershed’

Added Carney, the former Bank of England chief also named the United Nations special envoy for climate action and finance: “The money is here, but that money needs net-zero-aligned projects. … This is a watershed. Now, it’s about plugging it in.”

The Biden administration says it is doing everything it can to help. Treasury officials led a group of financial regulators last month in a new report underlining the risks posed by climate change to the financial system — a move intended to signal to private sector markets that they should shift their investments away from fossil fuel-intensive projects. Yellen has also held several meetings with the multilateral development banks and Treasury officials have said they have sped up the climate-related work at those institutions.

“The billions we are talking about here at COP in public funding — the new commitments being made here — are critically important,” John Morton, Treasury’s chief climate official, told reporters in Scotland on Tuesday. “But the question of how we get to the trillions required to finance the global transition is one that has to involve the private sector as a central player.”

Tags: #UNCOP26, #Phltotap$10-Bfund, #shiftingfromcoaltoRE, #environment, #climatechange