Pessimism heightened this fourth quarter among consumers who expect to be unable to buy big ticket items this quarter until next year as they expect to go up to 5.9 percent, above the target set by the government

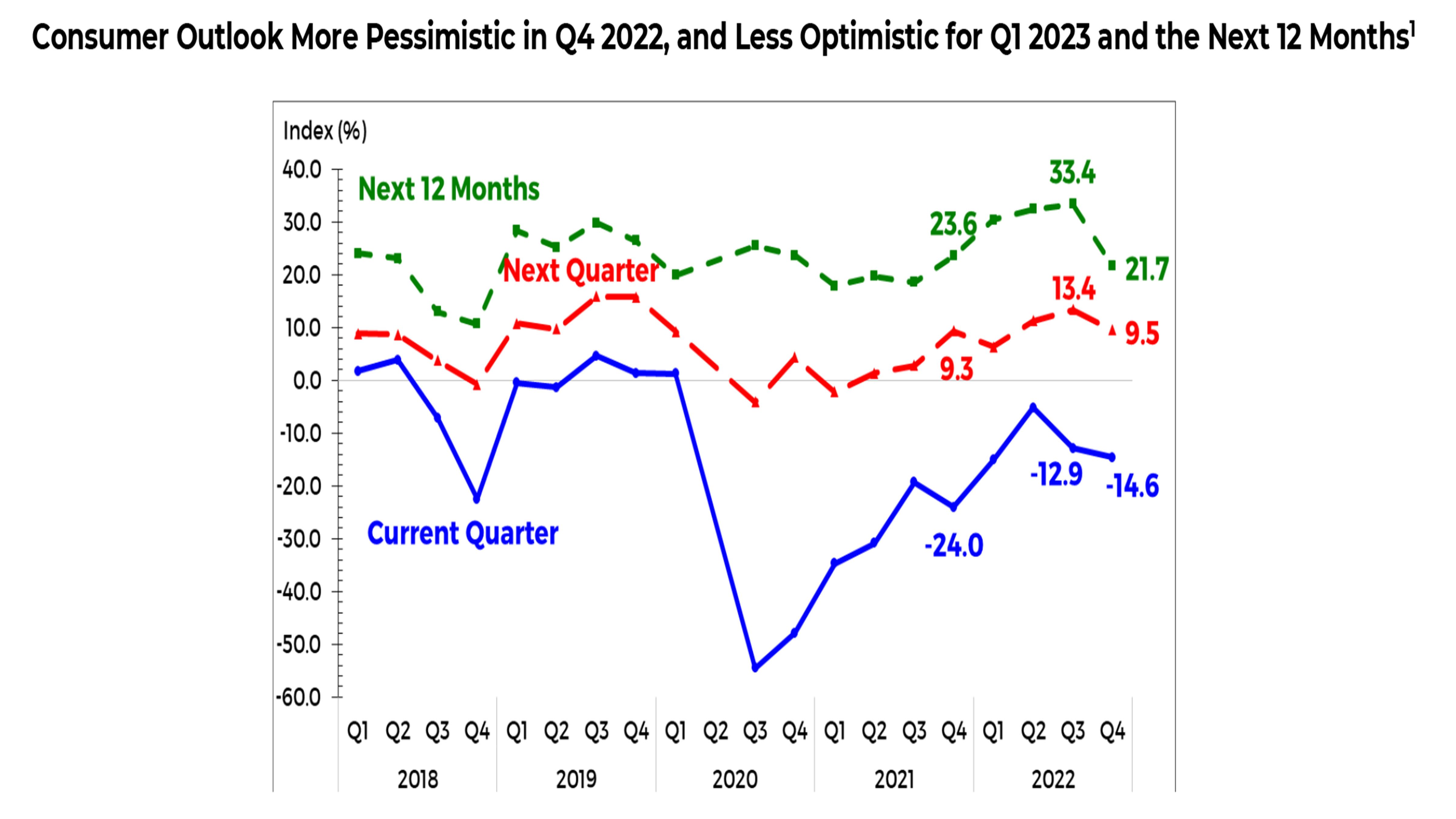

Consumers are more pessimistic this current quarter (Q4 2022) as overall confidence index (CI) dropped by -14.6 percent from -12.9 percent in the preceding quarter this year. The decline in CI in Q4 2022 indicates that the number of households with pessimistic views increased and continued to outnumber those with optimistic views.

The sentiment across the three component indicators of consumer confidence was mixed in Q4 2022, i.e., more pessimistic for the country’s economic condition, less pessimistic for the family’s financial situation, and steady for family income.

Mixed consumer outlook across income groups

Similarly, consumer sentiment was also mixed across income groups, i.e., less pessimistic among the low-income group, steady among the middle-income group, and more pessimistic among the high-income group.

More pessimistic buying sentiment on big-ticket items

The consumer sentiment on buying big-ticket items was more pessimistic in Q4 2022 as the CI declined to -74.5 percent from -72 percent in Q3 2022.

Slight decrease in households with loans while those with savings increases

In Q4 2022, 24 percent of households availed of a loan in the last 12 months, slightly lower than the 24.9 percent recorded in Q3 2022. However, the percentage of households with savings in the country rose to 30.5 percent from 27.5 percent in Q3 2022 with all income groups registering an increasing trend.

Lower unemployment rate expected

Consumers anticipated that interest and inflation rates may increase, the peso may depreciate against the US dollar, and the unemployment rate may decline in Q4 2022 and Q1 2023, and the next 12 months.

In particular, consumers expected the inflation rate to rise to 5.9 percent for the next 12 months, breaching the upper end of the National Government's inflation target range of 2 to 4 percent for 2022 and 2023.

Tags: #consumerconfidence, #pessimismworsensinQ42022, #BSP